Photo: Evgeny Razumny / Vedomosti

Banks do their best to fight for each client, issuing loans and mortgages to almost everyone. And developers come up with various schemes for the sale of apartments against the background of record interest rates. In this situation, the central bank has only one thing left to do – to fight the appetites of creditors and prevent Russians from becoming massively mired in debt.

Recently, the Central Bank decided to cool the lending market again against the background of a significant increase in the number of both issued and overdue loans. From October 1, 2023, the decision to issue a mortgage, and in general any loan, banks will take into account the updated risk coefficient. This means that the solvency of borrowers will be checked more thoroughly, which will provoke an increase in the number of refusals and an increase in interest rates for certain categories of citizens.

Risk ratio and other economics

To understand what will change and what the consequences will be, you need to figure out how the indicators are generally calculated and on the basis of which the bank makes a decision.

The fact is that when issuing a loan or mortgage, the bank is obliged to deposit an amount of funds to the Central Bank account, which will be enough to cover losses if the client stops paying. That is, the bank freezes part of its own funds for the duration of lending. This amount is calculated on the basis of the above-mentioned risk coefficient and, in fact, increases with it.

This tool protects banks from bankruptcy, because otherwise a commercial organization could distribute all its funds as loans and receive large losses in case of mass refusals from payments.

The risk coefficient is calculated for each client when issuing a mortgage. To calculate it, the bank uses only 2 parameters:

- The debt burden indicator is the ratio of a person’s income to his credit obligations. Let’s say your income is 50,000 rubles a month, and you pay 25,000 rubles a month on loans. Accordingly, your PD is 30%, which is very good.

- LTV – the ratio of the loan to the real value of the collateral. LTV shows the ratio of own funds and the bank’s funds when buying a home. For example, the cost of an apartment is 5 million rubles, of which 2.5 million you take on a mortgage. LTV in this case is 50%. For a mortgage under the DDA, this indicator is not considered, instead, the size of the PV is used as a percentage.

Risk factor allowances are not a new story from the Central Bank

The Central Bank has always had a tool to reduce the appetites of creditors and the arrogance of borrowers, but it began to be used only in December 2022, and with enviable regularity. Now there will be a bit of history:

The risk coefficient was revised for the first time on December 1, 2022. Then the changes affected only new buildings with a minimum down payment (up to 10%).

The last changes were made by the Central Bank on May 1, 2023. They have already affected not only the mortgage on the DDA, but also the purchase of apartments on the secondary market with a PV of 10-15%.

Why did you need a promotion?

The unstable situation in the country is to blame for everything. In March 2022, the key rate in Russia rose to a record 20%, shaking both the solvency of the population and the welfare of developers and banks. Mortgages have become more expensive, and there are fewer people willing to get it. There was only a preferential mortgage with the help of the state, but such programs are not massive. By the way, today the key rate is 14%, but the situation in the lending market has not improved from this.

Developers together with banks have come up with a scheme to attract customers, bypassing high rates. Apartments began to offer mortgages with minimum rates of up to 1%. It sounds profitable – in fact it turned out to be only for developers. The price of the apartment was raised by 30-40%, and the mortgage was given almost for nothing.

But the Central Bank decided that such programs are too risky for both the population and the economic situation. There are 3 objective reasons for this:

- A person who bought such an apartment will not be able to sell it profitably.

- In case of non-payment, the sale of such real estate will cause losses to the bank.

- The state will have to subsidize such a mortgage until the end, because there is no motivation for early repayment with such a rate.

Against this background, both the first and second tightening of requirements took place.

With the arrival of autumn 2023, the situation has not improved much. Banks continue to fight for customers, whether it’s a mortgage or a consumer loan. And now the Central Bank has come out with another tightening, because the amount of overdue loans has already exceeded 1 trillion rubles, and the market may not survive a series of bank failures.

What awaits us now?

From October 1, 2023, the Central Bank introduced a surcharge to the risk coefficient. That is, banks will continue to decide on their own who to give a loan to, but for potentially dangerous borrowers they will have to freeze more funds on the Central Bank account. For the bank, this is an additional burden and the loss of part of the funds that can be directed to lending to more reliable customers.

Now, according to these 2 parameters, customers will be divided into groups. Nothing will change for reliable and solvent customers. But those who are credited and who want to take out a mortgage with a small down payment will face refusals or a significant increase in the interest rate, because banks also need to earn.

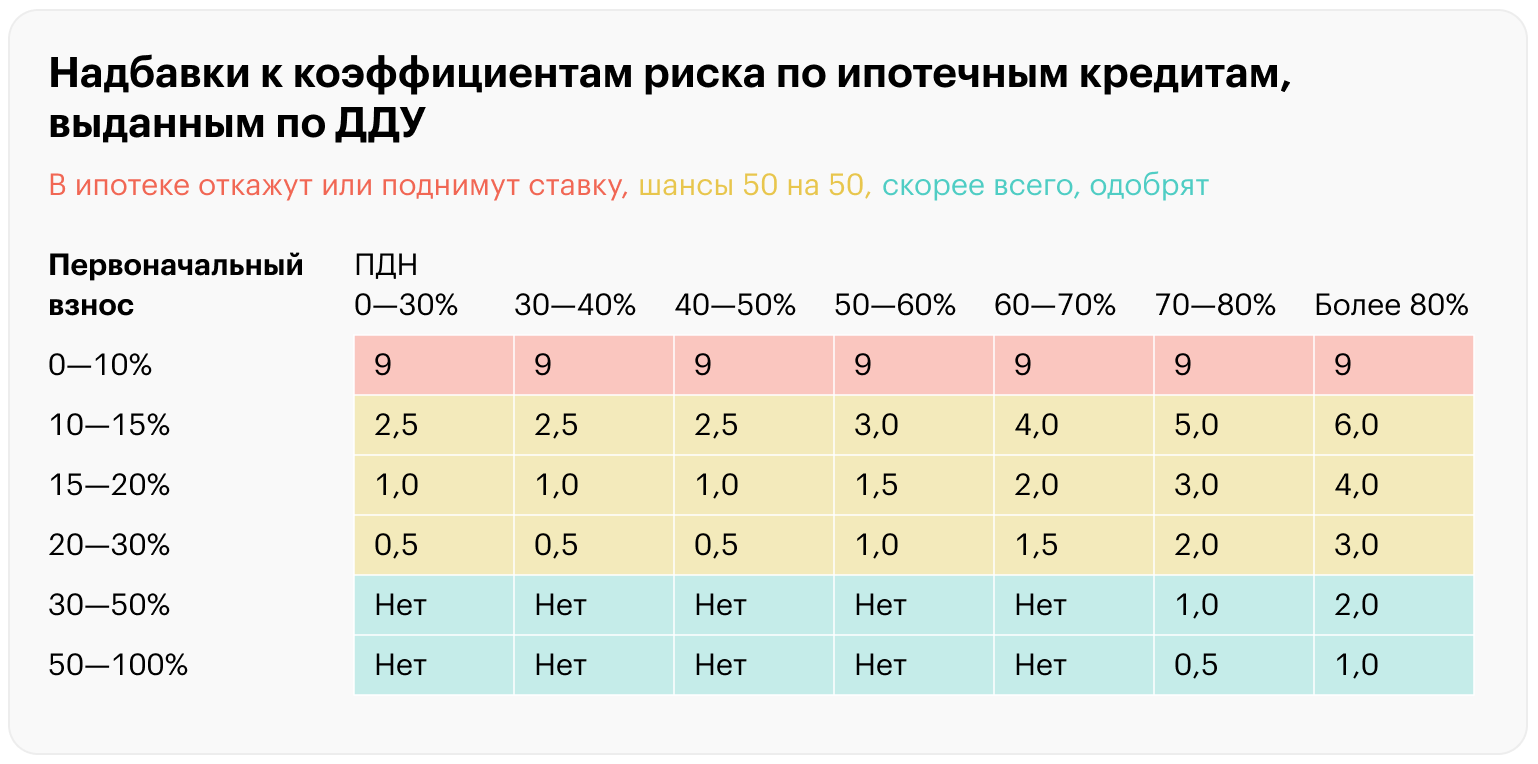

Table: CBR

In the primary market, borrowers with a PD of up to 50-60% and a down payment of at least 20% will have no problems.

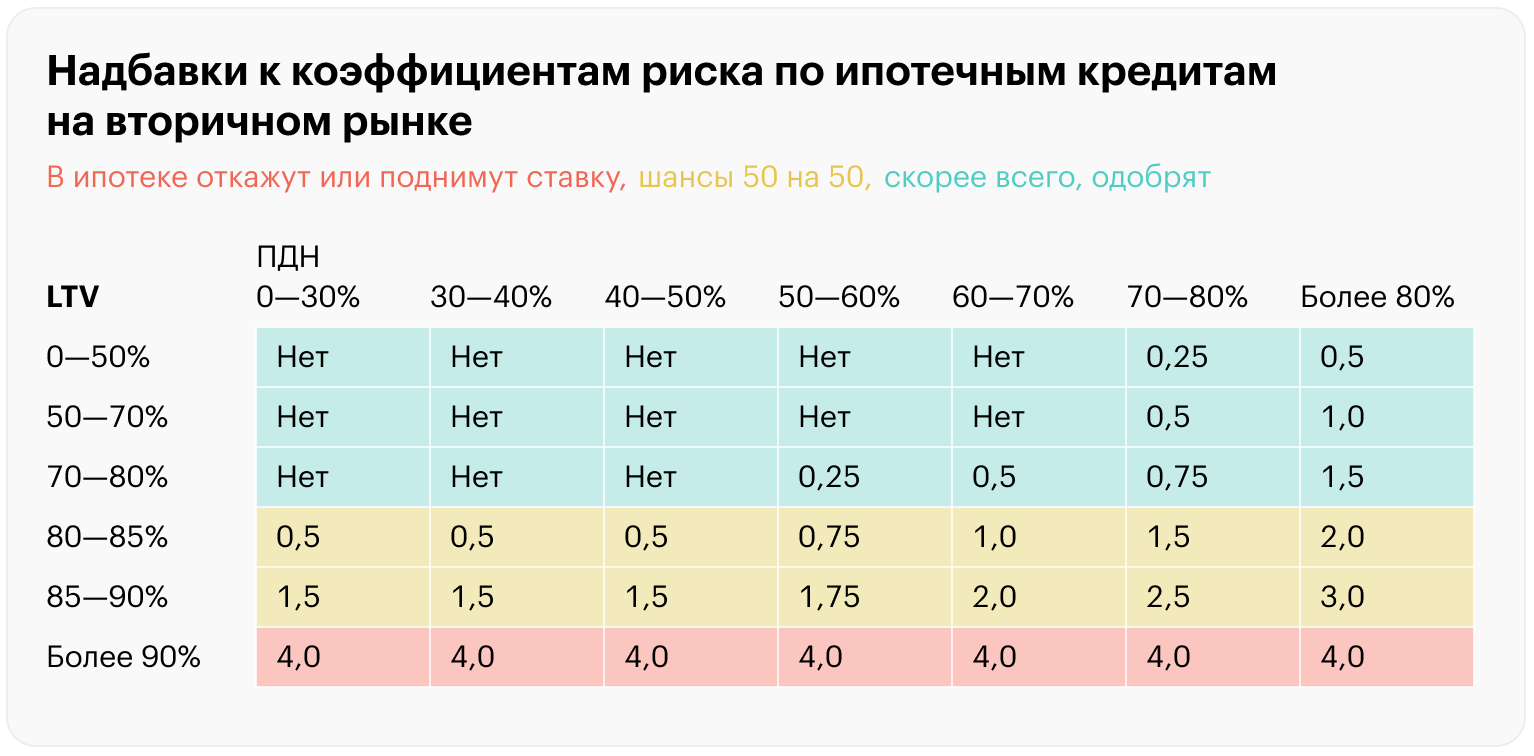

Table: CBR

On the secondary, everything is much simpler. Nothing will change for clients with loans up to 70% and the ratio of borrowed money to their own up to 80%.

What should I remember?

- From October 1, the verification of borrowers will be carried out more carefully, so be prepared to provide more information and wait longer for a decision.

- Customers with a low interest on PD and a low loan-to-collateral ratio/high down payment may not worry, the risk factor surcharge does not apply to them.

- Those who are credited and want to buy an apartment with a minimum down payment will more often receive refusals or offers with an increased interest rate.